From managing complex international corporate investment vehicles to implementing attractive employee incentive arrangements, administering structures with environmental or sustainability objectives or supporting group structuring requirements, we can help.

Our team focuses on what really matters to clients. By offering continuity, consistency, technical and service excellence, we have worked with small-medium size businesses and national to multi-national listed corporations to deliver tailored corporate administration solutions to support the entire company lifecycle.

What are you looking for?

→ A comprehensive, efficient, and long-term company administration partner to take care of entity formation, management, and transaction support so that you can focus on fuelling your business growth?

→ An expert in Islamic Finance such as Shari'a compliant structures?

→ An expert team to provide management and administration services to equity and debt issuances, securitisation, structured and alternative finance transactions?

→ To establish a structure to support commercial and residential real estate ownership, development and investments globally?

→ Assistance with your employee incentive arrangements through employee benefit trusts, corporate nominee arrangements and/or share plan administration?

→ To list bonds on The International Stock Exchange (TISE)?

Our corporate administration solutions

Real Estate

We work with clients globally to administer their portfolios of investments and commercial real estate is one of our largest asset classes under administration. From multi let offices in the City of London to logistic centres in Holland, student accommodation in the UK to shopping centres in Italy and retail parks in Scotland to large commercially let buildings in the USA, we oversee a diverse range of internationally located real estate for a variety of clients and their tenants, including FTSE100 and NASDAQ listed companies. Whether our client’s strategy involves financing, acquisition, development, rental or buy-and-hold assets, our comprehensive, technical, and practical expertise provide a safe pair of hands.

Our depth and breadth of asset class experience is complemented by our team’s extensive technical knowledge of the range of vehicles available to hold real estate investments including Jersey Property Unit Trusts (JPUTs), real estate investment trusts (REITs), limited partnerships, and Jersey holdings companies.

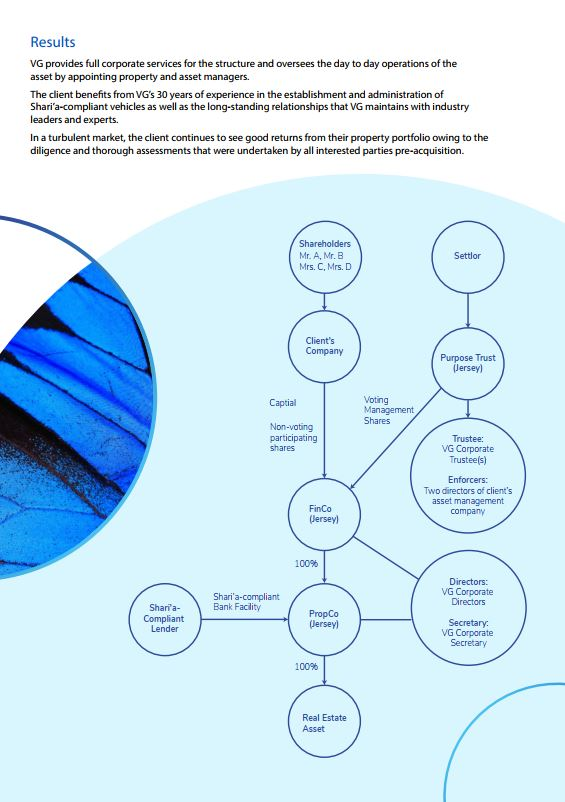

We are recognized for our market-leading knowledge and award-winning expertise in administering Shariah-compliant real estate structures. We understand the intricacies and nuances of meeting different cultural and transactional requirements across the globe and the importance of getting it right.

Renowned not only for our experience and track record we have worked alongside partners on several ‘first-ever’ deals including the first Jersey-domiciled Shariah-compliant fund investing in US real estate and the first Shariah-compliant fund listed on TISE.

Islamic Finance

We are recognised for our market-leading knowledge and award-winning expertise in administering Shariah-compliant real estate structures.

We understand the intricacies and nuances of meeting different cultural and transactional requirements across the globe and the importance of getting it right.

Download the case study: Expanding a Property Portfolio Through Shari'a-Compliant Lenders via a Commodity Murabaha.

Debt Capital Markets

Our senior management team has extensive experience of capital markets and debt instrument transactions. Whether public or privately placed bonds, secured loan warehouse facilities, finance leasing, sukuk transactions, asset backed securities (ABS), aircraft leasing, residential and commercial mortgage-backed securities, collateralised loan obligations (CLOs), insurance-linked securities, project finance, SME loan structures, alternative finance or bonds, we can help.

We act for originators, arrangers, lead legal counsel and structurers in establishing and administering debt capital markets transactions. Whilst we usually act for the issuer special purpose vehicle (SPV), we are also able to provide trustee and agency services where required.

Employee Incentives and Share Plan Administration

In a competitive employment market, an attractive employee incentives offering is crucial for motivating and retaining key employees as well as recruiting and attracting new talent. We know that the top priorities for organisations when implementing their incentive arrangements are flexibility, on-boarding efficiency and cost transparency.

We can enact complex, bespoke and regular solutions to meet the needs of businesses of all sizes, from evolving private companies and private equity portfolio companies to large multi-national organisations managing various arrangements for their workforce. We can support various plans including share warehousing, share option plans, deferred remuneration schemes and management incentive plans to name a few, whether this be through the use of an employee benefit trust or corporate nominee arrangement, or both.

Share Plan Administration

VG offers a full share plan administration service. A dedicated and experienced team will set up, track and manage your discretionary incentive arrangements accurately and efficiently.

- 24/7 access to an online platform for participants to view their holdings, make elections and view plan rules and documentation.

- Optional automated processing of exercises or releases and calculation of vesting amounts.

- Bespoke reports help the company with tax filings and participants with dividend vouchers.

VG's flexibility allows us to work with a range of legal advisors and brokers and we tailor our fees for trustee services, administration and accounting.

Article: Get your share plans IPO ready

Eyeing an IPO? Danny Curran, Director of Corporate and Business Development, explains why it's essential to review your employee share plans early and how an employee benefit trust could be a wise move.

Click the image to doenload the article.

Tailor-made solutions

Corporate service provider administration and fiduciary solutions are vast; since 1982 our team have enacted a diverse range of solutions for our clients using Jersey vehicles for target asset acquisition, corporate restructurings, schemes of arrangement, cross-border M&A activity and financing services. However complex or bespoke your requirement, we will work with you and your advisers to enact the right solution.

TISE listing member services

We are a Category 1 and 2 TISE member and can act as an agent and sponsor for debt and real estate instruments to be listed on the Exchange.

Entity establishment

We know that the prompt establishment of an entity in line with relevant local regulation and compliance is key. We will work alongside your professional advisers to understand the type of entity to set up and the key features to be considered within your timescales.

Company secretarial

Adherence to local laws and regulations is critical when operating a company in one or multiple jurisdictions. Our comprehensive corporate secretarial solutions ensure that your entity remains compliant and include:

→ Provision of a registered office, local and overseas statutory and tax filings

→ Provision of company secretary and other required officers, and administration services

→ Provision of Personal or Corporate Directors

→ Maintenance of all corporate books and records, including attendance at board meetings and accurate minute taking

→ Bank account opening and cash management

Accounting and reporting

Companies operating in multiple jurisdictions face complex and often time-intensive accounting and reporting obligations, made more cumbersome by differing local reporting requirements. To keep abreast of these obligations, we can provide a bespoke range of services tailored to your company including:

→ Bookkeeping, financial reporting and management accounts

→ Assistance with financial audit and internal control

→ Tax and VAT registration and administration

→ Statutory accounting in FRS102 (UK GAAP), IFRS, US GAAP and other international standards

→ Filing of accounts with relevant local authorities

→ Investor reporting

What can you expect from us?

Nimble, agile, and quick to respond

We pride ourselves on exceeding our clients’ expectations; our independent ownership means that our in-house directors can make decisions quickly without approval from a parent company. We manage the collation of customer due diligence, workflows, and transactions pragmatically to ensure that they are completed efficiently and on time. We will partner with you and your advisers to understand your objectives and find the right solution; if we think there is a better solution, we will let you know.

Long-term, consistent, and hands-on relationships

Solid relationships are based on open communication, shared vision, and trust. Each client relationship is director-led meaning that you will always have direct access to key decision makers who can respond quickly. Your lead director will be supported by a handpicked and dedicated team with the experience and qualifications to meet your needs. We maintain regular contact, are proactive in our approach and our team responds promptly to enquiries to give you, your team, and advisers information in a timely manner.

Cultural understanding

We are recognized for our market-leading knowledge and award-winning expertise administering Shariah-compliant structures; we understand the intricacies and nuances of meeting different cultural requirements across the globe and the importance of getting it right.

Strategic partner

In an evolving and dynamic industry, you need a strategic partner. No matter the sophistication or complexity of your structure we will work with you to create and maintain a robust corporate governance framework, ensure you receive accurate, regular regulatory, tax and compliance reporting.

We are transparent

We are clear on what we can do and by when, so you know what to expect. Our ‘no surprises’ culture means we can offer a fixed or time based fee quote and forewarn you if we need to go beyond the agreed scope of work.